2025 How to Buy Manufactured Homes: Tips for First-Time Buyers

The manufactured homes market has seen significant growth over the past decade, emerging as a practical and affordable housing solution for many Americans. According to the U.S. Census Bureau, approximately 20 million people currently live in manufactured homes, highlighting their crucial role in the nation’s housing landscape. These homes offer a unique combination of affordability, flexibility, and modern amenities, making them an attractive option for first-time buyers grappling with the rising costs of traditional housing.

As we approach 2025, understanding the nuances of purchasing manufactured homes becomes imperative for potential buyers. A report from the Manufactured Housing Institute reveals that manufactured homes can be 10 to 35 percent less expensive than site-built homes, providing a viable option for those looking to enter the housing market without the burden of insurmountable financial pressure. With various financing options available, it is crucial for first-time buyers to familiarize themselves with the specific steps involved in purchasing manufactured homes, ensuring they make informed decisions that align with their budget and lifestyle.

Understanding Manufactured Homes: What First-Time Buyers Need to Know

Understanding manufactured homes is crucial for first-time buyers looking to make informed decisions. These homes are built in factories and then transported to their designated locations, offering a cost-effective and efficient housing option. As a first-time buyer, it’s essential to differentiate between the various types of manufactured homes, such as single-wide, double-wide, and modular homes. Each type has unique advantages and considerations, particularly in terms of space, layout, and resale potential.

When buying a manufactured home, consider these crucial tips. First, thoroughly research the manufacturer and ensure they have a solid reputation for quality and customer service. This can help you avoid issues down the line. Second, understand the financing options available to you; some lenders specialize in manufactured homes, which can offer better terms than traditional mortgages. Lastly, always inspect the home before making a purchase. Check for structural integrity, plumbing, and electrical systems to ensure everything meets safety standards and your expectations. By following these guidelines, first-time buyers can navigate the manufactured home market with confidence.

2025 Manufactured Homes: Key Cost Factors for First-Time Buyers

Exploring Different Types of Manufactured Homes Available in 2025

In 2025, the landscape of manufactured homes offers a diverse array of options for first-time buyers, catering to various needs, preferences, and budgets. One popular choice is the single-section home, which typically ranges from 600 to 1,200 square feet. These homes are ideal for small families or individuals looking for an affordable housing solution, with costs averaging around $50,000 to $100,000. According to the Manufactured Housing Institute, there has been a consistent growth in the acceptance of single-section homes due to their affordability and efficiency in construction.

On the other hand, multi-section manufactured homes are gaining traction among those seeking more space and luxury features. These homes can be as spacious as 2,000 square feet and often include multiple bedrooms and bathrooms, making them suitable for larger families. The latest reports show that about 40% of manufactured homes sold in recent years fall within this category, with prices ranging from $100,000 to $200,000. The increasing demand for eco-friendly and energy-efficient options has led manufacturers to incorporate advanced technologies, making multi-section homes not only stylish but also sustainable, reflecting the industry's shift towards greener construction practices.

Another emerging trend is the rise of modular homes, which are prefabricated off-site and assembled on location. While often confused with traditional manufactured homes, modular homes offer greater customization and compliance with local building codes. The average price for modular homes can start around $150,000 and go significantly higher depending on design choices. As the market continues to evolve, first-time buyers should explore the differences and benefits of these various types of manufactured homes to make informed decisions tailored to their lifestyles and financial goals.

Financial Considerations: Budgeting for Your Manufactured Home Purchase

When considering the purchase of a manufactured home, financial planning is paramount. First-time buyers should begin by evaluating their budget, which includes not just the home’s purchase price, but also additional costs such as land lease, utilities, maintenance, and insurance. It’s essential to create a comprehensive budget that outlines all potential expenses to avoid any financial surprises down the line. A clear understanding of monthly payments, including any financing options, will help ensure that the home fits comfortably within the buyer's financial capabilities.

To further refine budgeting, prospective buyers should investigate financing options available specifically for manufactured homes. Many buyers may qualify for loans that cater to manufactured housing, which often have different terms than traditional home financing. It’s advisable to compare interest rates and assess the total cost over the life of the loan. Additionally, setting aside a contingency fund for unexpected repairs or changes in living expenses can provide further financial security. By assessing these financial considerations, first-time buyers can navigate the purchase of a manufactured home with greater confidence and peace of mind.

The Buying Process: Steps to Successfully Purchase a Manufactured Home

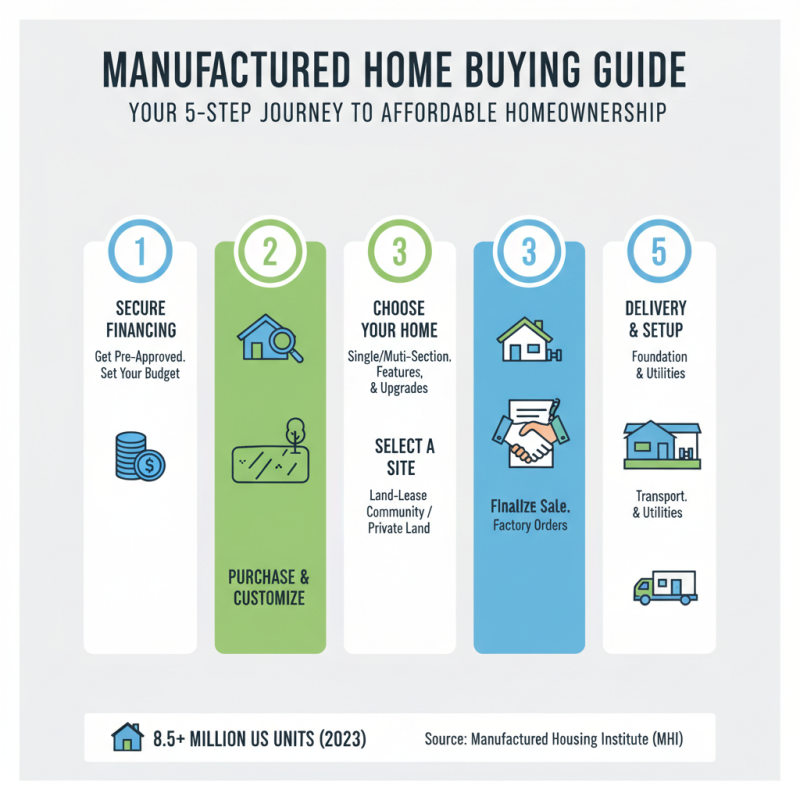

When considering the purchase of a manufactured home, it's essential to understand the buying process thoroughly. According to the Manufactured Housing Institute (MHI), manufactured homes represent a significant portion of the affordable housing market in the U.S., with over 8.5 million units occupied nationwide as of 2023. This sector often appeals to first-time buyers due to competitive pricing and flexible financing options. Prospective buyers should start their journey by securing pre-approval for financing, which allows them to establish a budget and understand the types of homes they can afford.

After determining a budget, the next step in the buying process is to research different models and communities. It’s important to consider factors such as location, amenities, and resale value. A report published by the National Association of Realtors (NAR) in 2022 indicates that manufactured homes can appreciate in value similar to site-built homes, provided they are located in desirable communities and well-maintained. Once a suitable home is identified, buyers should engage in due diligence, which includes obtaining inspections and testing for quality assurance. This step not only ensures that the home meets safety standards but also prevents future financial burdens from hidden repair costs.

Key Factors to Consider When Choosing a Location for Your Home

When considering the purchase of a manufactured home, one of the most critical aspects is the location. According to the U.S. Census Bureau, around 22 million Americans live in manufactured homes, increasingly driven by the affordability and flexibility they offer. However, the right location can significantly impact your lifestyle, property value, and future resale potential.

First-time buyers should prioritize areas with strong employment opportunities, quality schools, and access to essential services. A report from the Consumer Financial Protection Bureau highlights that the average appreciation rate for manufactured homes can vary greatly by region, emphasizing the importance of choosing a growing community. For instance, suburban areas with access to larger urban centers often see higher appreciation rates, providing a safer investment for buyers. Additionally, examining local zoning regulations and land lease agreements is crucial; these factors can affect long-term ownership costs and land use, with recent data suggesting that leasing land can sometimes lead to unexpectedly high financial burdens over time.

Furthermore, a survey conducted by the Manufactured Housing Institute indicates that proximity to amenities like shopping, healthcare, and recreational facilities significantly boosts homebuyers' satisfaction. Communities with higher walkability scores often attract more buyers, not just for the immediate convenience but also for long-term desirability. Therefore, when choosing a location for your manufactured home, evaluate these key factors to ensure you make a well-informed decision that aligns with your lifestyle and investment goals.

2025 How to Buy Manufactured Homes: Tips for First-Time Buyers - Key Factors to Consider When Choosing a Location for Your Home

| Factor | Importance Level | Considerations |

|---|---|---|

| Location Accessibility | High | Proximity to main roads, public transport, and essential services. |

| Community Amenities | Medium | Access to parks, schools, shopping, and healthcare facilities. |

| Safety and Crime Rates | High | Research the local crime statistics and neighborhood safety. |

| Property Taxes | Medium | Understand the local tax rates and potential increases. |

| Future Development Plans | Medium | Investigate any planned developments that could affect property value. |

| Zoning Laws | High | Ensure the land is zoned for manufactured homes and check restrictions. |

Related Posts

-

Exploring the Benefits and Future of Premanufactured Homes: A New Era in Housing Solutions

-

The Ultimate Guide to Sustainable Living in Boxcar Homes

-

2025 Top Digital Trends Shaping the Future of Boxcar Homes and Sustainable Living

-

10 Essential Tips for Choosing Container Homes with 95 Percent Satisfaction Rate

-

Top 10 Benefits of Transportable Container Homes for Modern Living

-

How to Build Steel Modular Homes in 2025 for Sustainable Living